In a landmark decision, California has taken a significant step toward preparing high school students for independent adulthood by instituting a new requirement for graduation: financial literacy education. This initiative is not just a curriculum addition but a powerful tool that will provide young Californians with the knowledge and skills they need to navigate the complex financial landscape of adulthood.

Financial literacy as a mandatory subject is recognition of a long-overdue need in our education system. For too long, students have graduated high school with a thorough understanding of the periodic table, but no concept of what a credit score is. Without a basic understanding of how money works, young adults are vulnerable to predatory lending practices and are much more likely to cave to the financial temptations that adults face every day. Should I apply for that retail credit card and get an additional 25% off?

Why this is Important

By making financial literacy a requirement, California is proactively attempting to better prepare young adults to make smart financial decisions and avoid hazardous practices, which often target high school graduates, taking advantage of their inexperience with personal finance and their desire for instant gratification. Eager to establish independence, these young adults can fall prey to high-interest credit cards, payday loans, and “buy now, pay later” lending programs.

Not to mention the growing sophistication of lending schemes which make it increasingly difficult for a TikTok generation who believes social media is truth to distinguish legitimate offers from exploitative ones. You might be thinking, “my child would not become a victim of a financial scheme.” However, the allure of designer sneakers, high-end gaming consoles, and brand name yoga pants is sometimes too tempting to pass up, even for the most mature 18-year-old.

Consequently, high interest rates, hidden fees, and misleading terms can quickly spiral into overwhelming debt, damaging credit scores and leading to a cycle of financial instability that is difficult to escape. Through education in financial literacy, California aims to equip its youth with the tools needed to navigate this complex landscape, fostering a generation that can resist these temptations and make sound financial choices.

Why Financial Literacy Matters

According to a survey by the National Financial Educators Council, 75% of young adults feel ill-equipped to manage their finances. Lack of financial education can lead to costly mistakes that some individuals never recover from.

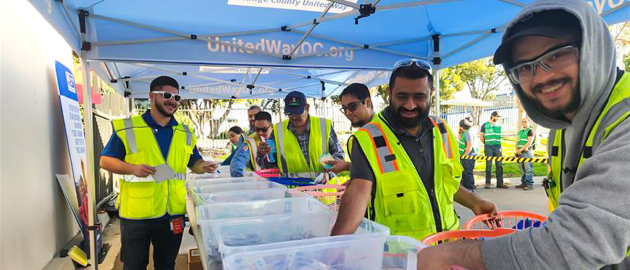

However, there are valuable resources that can help, and we have seen the power of financial literacy coaching through financial empowerment programs such as Orange County United Way’s Sparkpoint OC, which provides financial coaching to adults seeking to recover from financial missteps often made during their youth. Sparkpoint OC staff regularly encounter participants who require assistance with managing collection accounts—many of which stem from retail credit cards opened when they were younger. These programs are essential in helping individuals regain control of their financial health, offering both guidance and practical solutions for navigating past debts and building a more stable and secure financial future.

California’s decision to require financial literacy in high schools is a significant step forward, offering the opportunity to equip teens with the money management skills to master everything from setting up smart budgets to planning for major life goals like college, a car, or a house. After all, don’t we want our young people to manage their finances as skillfully as they manage their social media feeds?

The article was written by Andrew Fahmy, the Executive Director of the United for Financial Security Initiative at Orange County United Way and an appointed member of the Orange County Workforce Development Board.